When you pick up a prescription, you might not realize there are two very different kinds of generic drugs on the shelf - and they can cost you very different amounts. One is made by the original brand company but sold under a generic label. The other is made by a rival company that raced to be first to file for approval. These are called authorized generics and first-to-file generics. And the difference between them can mean the difference between paying $10 or $30 for the same pill.

What Exactly Is an Authorized Generic?

An authorized generic isn’t a knockoff. It’s the exact same drug, made in the same factory, with the same ingredients, and the same packaging - just without the brand name. The brand-name company licenses it to a generic distributor or sells it directly under a different label. For example, if you buy the authorized generic version of Lipitor, it’s made by Pfizer, the same company that makes the brand-name version. It’s not a copy. It’s the real thing, repackaged. These drugs can enter the market at any time. They don’t need to wait for patent expiration or go through the full FDA approval process because they’re covered under the original brand’s New Drug Application (NDA). That means they can show up even before the first traditional generic hits the shelves.What Is a First-to-File Generic?

A first-to-file generic is the opposite. It’s made by a separate company that submitted the first Abbreviated New Drug Application (ANDA) to the FDA after a brand drug’s patent expired. Under the Hatch-Waxman Act of 1984, that company gets 180 days of exclusive rights to sell the generic version - no other generic can compete during that time. This exclusivity is a huge deal. It’s worth hundreds of millions of dollars to the generic manufacturer. During those 180 days, they’re the only game in town. That gives them pricing power. They can set prices high - sometimes close to the brand price - and still make massive profits because no one else is selling the same drug.Price Differences: The Real Numbers

Here’s where it gets interesting. The Federal Trade Commission (FTC) tracked over 95 drugs and found clear patterns:- In markets with only a first-to-file generic (no authorized generic), the average retail price is about 14% lower than the brand-name drug.

- When an authorized generic enters the market at the same time, the price drops to 18% below the brand - a 4 percentage point jump in savings.

- Without authorized generic competition, pharmacies pay 20% less than the brand price.

- With an authorized generic in the mix, that jumps to 27% less - a 7-point difference.

Why Does the Authorized Generic Drop Prices So Fast?

It’s simple economics: more competition = lower prices. When the first-to-file generic has no rivals, they can charge more. But as soon as an authorized generic appears - even if it’s made by the same company that made the brand - it puts pressure on prices. The authorized generic doesn’t need to build a new factory or prove bioequivalence. It’s already made. It’s already approved. It can flood the market instantly. That forces the first-to-file generic to slash prices to stay competitive. The FTC found that when an authorized generic enters during the 180-day exclusivity window, it cuts the first-filer’s revenue by 40% to 52%. And that hit doesn’t go away after 180 days - revenues stay lower for at least 30 months.

Who Benefits? The Pharmacy, the Patient, the System

You might think pharmacies lose out when prices drop. But the opposite is true. Gross profit per prescription goes up when an authorized generic joins the market. Why? Because even though the selling price drops, the cost to the pharmacy drops even more. The spread between what they pay and what they charge widens. Patients win too. Lower prices mean lower out-of-pocket costs, especially for those without insurance or with high deductibles. The healthcare system saves billions. Medicare, Medicaid, and private insurers pay less per prescription. That means more money stays in the system for other treatments.What About the Brand Company? Are They Losing Money?

Yes - but strategically. The brand company doesn’t make as much on the brand version anymore. But by launching an authorized generic, they capture a chunk of the generic market. Instead of losing all revenue to a rival generic maker, they keep some of it. It’s a way to soften the blow of losing patent protection. Some critics say this is a trick - a way for big pharma to delay real competition. But the FTC’s research found no evidence that authorized generics reduce the number of patent challenges by generic companies. In fact, generic firms still file ANDAs at the same rate. The 180-day exclusivity incentive is still strong enough to drive competition.What Happens When More Generics Enter?

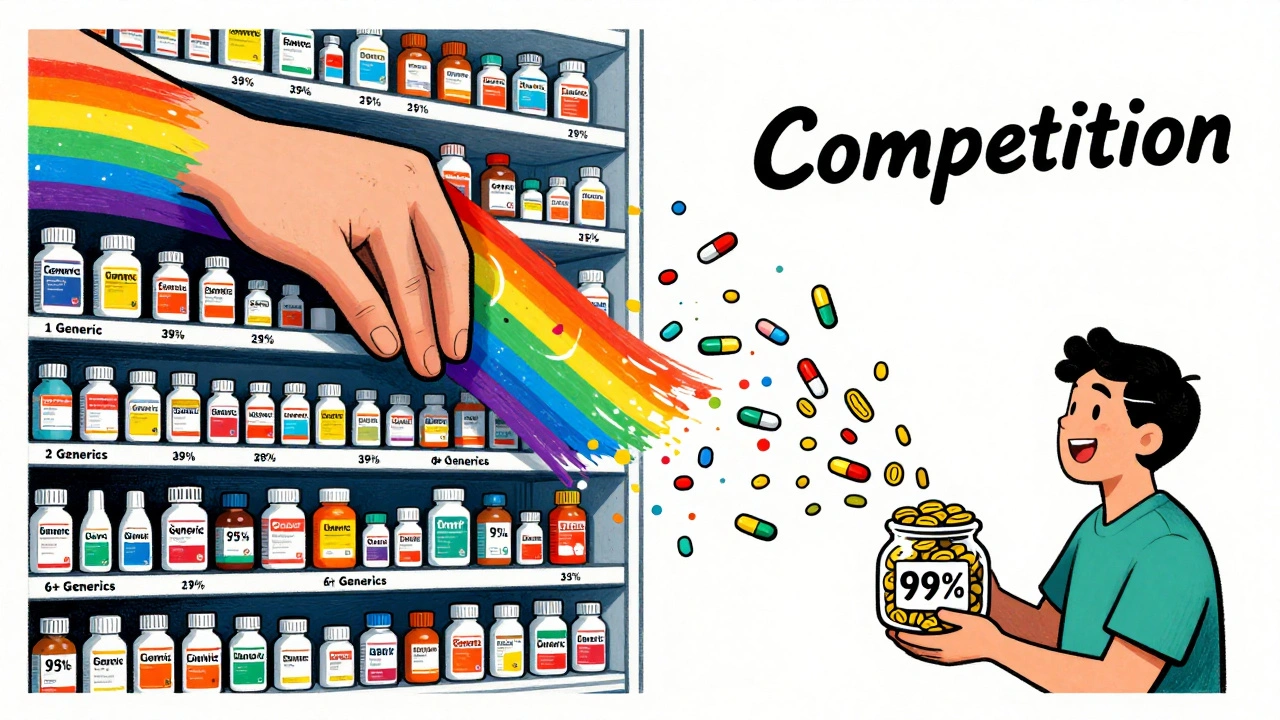

The real price crash comes when multiple generics flood the market. The FDA found:- With one generic (first-to-file only): prices are 39% lower than brand.

- With two generics (first-to-file + authorized generic): prices drop to 54% lower.

- With four generics: prices fall to 79% lower.

- With six or more: prices drop over 95% below brand.

Lynette Myles

December 5, 2025 AT 23:51Authorized generics aren't a loophole-they're a corporate puppet show. The brand company makes the generic, controls the supply, and still pockets the profit. The FTC calls it competition. I call it theater.

They don't want real generics. They want you to think you're saving money while they still own the game.

Annie Grajewski

December 7, 2025 AT 08:35so like… if pfizer makes the ‘generic’ lipitor… is it still lipitor but with a blank label?? like a drug version of a plain white t-shirt with the logo cut out??

also why does my pharmacist look at me like i’m asking for the moon when i ask if it’s ‘authorized’??

also also-did anyone else notice the word ‘pharma’ appears 17 times in this post? just sayin’.

Jimmy Jude

December 8, 2025 AT 04:00Let’s be real-this isn’t about savings. It’s about power.

The brand company doesn’t want to lose control. It wants to own the transition from patent to generic like a ghost haunting its own corpse.

And the first-to-file? They’re the punk rock band that crashes the stage-loud, chaotic, but doomed once the corporate machine rolls in with its silent, identical twin.

We’re not talking about pills. We’re talking about capitalism’s last magic trick: making you pay less while they still win.

Rupa DasGupta

December 8, 2025 AT 12:19OMG I just cried reading this 😭

My mom’s blood pressure med went from $45 to $12 when the authorized generic came in-she cried too.

But then last month it jumped to $18 again because the pharmacy switched to the ‘first-to-file’ one… why does this feel like emotional abuse??

Why can’t we just fix the system?? 💔

ashlie perry

December 9, 2025 AT 07:42They let the brand company make the generic so they can pretend there’s competition

It’s not a discount it’s a distraction

And no one talks about how the first-to-file gets paid off to delay

They’re all in on it

Juliet Morgan

December 9, 2025 AT 13:05Just wanted to say-this is the kind of info that changes lives.

If you’ve ever skipped a dose because it was too expensive, please, ask your pharmacist about authorized generics.

You’re not being picky-you’re being smart.

And you deserve to feel better without going broke.

You got this 💪

Katie Allan

December 10, 2025 AT 05:16This is one of those rare moments where the system almost works.

Not perfectly, not fairly-but the presence of multiple generic pathways does create real downward pressure on prices.

It’s not about trust in pharma. It’s about structural incentives.

More competitors = lower prices. Always.

Let’s not romanticize the brand company, but let’s not ignore the fact that their authorized generic is still helping millions save money.

The goal isn’t purity-it’s access.

Deborah Jacobs

December 10, 2025 AT 18:22Imagine if every drug came with a little label: ‘This one’s the ghost version made by the same folks who made the original’ vs ‘This one’s the scrappy underdog who just got lucky with paperwork.’

People would freak out.

But we don’t get labels like that.

We get bills.

And silence.

And the quiet rage of people who just want to take their pills without doing a PhD in pharmaceutical economics.

Krishan Patel

December 11, 2025 AT 14:47Pathetic. The entire system is rigged. The FDA is a puppet. The FTC is a joke. And you people are celebrating a 4% price drop like it’s a miracle?

Big Pharma invented authorized generics to maintain monopoly control under the guise of competition.

This isn’t capitalism-it’s feudalism with pill bottles.

And you’re thanking them for crumbs.

Carole Nkosi

December 11, 2025 AT 20:24You think this is about money?

No.

This is about control.

Who owns your body when you need medicine?

The brand? The regulator? The pharmacist?

Or the invisible hand that only moves when it makes a profit?

We are not patients.

We are consumers.

And that’s the real tragedy.